4 Green Plant Tax Incentives for 2015

By Rob Freeman | March 9, 2015

Category:

Plant managers and owners who pursue LEED® certification and green building projects benefit from reduced energy and water bills and improved building occupant productivity; they’re also rewarded for their efforts through a range of federal, state, and local government tax credits and deductions.

Editor’s Note: Tax Day April 15 is only a month away. Taxes on your mind? Looking for tax deductions and incentives? Here are four green plant tax incentives that you can access while greening your plant to ease the pain. This article was first published in the Jan. 26 edition of Poplar Network.

LEED® and green building project owners don’t just benefit from reduced energy and water bills and improved building occupant productivity; they’re also rewarded for their efforts through a range of federal, state, and local government tax credits and deductions.

Other financial incentives tied to building green are often are available as well, such as long-term, low-interest-rate financing and grants tied to renewable energy investment.

Four tax incentives help accelerate building projects’ ROI.

While these incentives change every year, here are four green building programs you may be able to take advantage of in 2015:

Recently extended as part of the Tax Extenders Law, section 179D (aka the green building tax deduction) offers new or existing building owners up to $1.80 per square foot to install (1) high-efficiency interior lighting; (2) efficient building envelopes, or (3) heating, cooling, ventilation (HVAC), or hot water systems.

Qualifying systems must reduce the building’s total energy and power cost by 50 percent or more in comparison to a building meeting minimum requirements set by ASHRAE Standard 90.1-2001.

Energy savings must be calculated and verified by a qualified professional engineer and by using qualified computer software approved by the IRS.

In the past all 179D-qualified software had to have been tested according to ANSI/ASHRAE; however, the U.S. Department of Energy (DOE) recently developed the “179D DOE Calculator,” a free online tool, as a substitute for other premium energy modeling software. It provides calculations to determine eligibility for the 179D federal tax deduction. In just a few clicks you can tell whether your building qualifies.

Business Energy Investment Tax Credit (ITC)

The Business Energy Investment Tax Credit, or “ITC” as it’s known, was expanded by the American Recovery and Reinvestment Act of 2009 and provides dollar-for-dollar tax credits for eligible systems placed in service on or before December 31, 2016.

According to the Department of Energy’s Database of State Incentives for Renewables and Efficiency (DSIRE) website, the following green building systems are eligible for the ITC:

Solar: The credit is equal to 30 percent of expenditures, with no maximum credit. Eligible solar energy property includes equipment that uses solar energy to generate electricity, to heat or cool (or provide hot water for use in) a structure, or to provide solar process heat. Hybrid solar lighting systems, which use solar energy to illuminate the inside of a structure using fiber-optic distributed sunlight, are eligible. Passive solar systems and solar pool-heating systems are not eligible.

Fuel Cells: The credit is equal to 30 percent of expenditures, with no maximum credit. However, the credit for fuel cells is capped at $1,500 per 0.5 kilowatt (kW) of capacity. Eligible property includes fuel cells with a minimum capacity of 0.5 kW that have an electricity-only generation efficiency of 30 percent or higher. (Note that the credit for property placed in service before October 4, 2008, is capped at $500 per 0.5 kW.)

Small Wind Turbines: The credit is equal to 30 percent of expenditures, with no maximum credit for small wind turbines placed in service after December 31, 2008. Eligible small wind property includes wind turbines up to 100 kW in capacity. (In general, the maximum credit is $4,000 for eligible property placed in service after October 3, 2008, and before January 1, 2009. The American Recovery and Reinvestment Act of 2009 removed the $4,000 maximum credit limit for small wind turbines.)

Geothermal Systems: The credit is equal to 10 percent of expenditures, with no maximum credit limit stated. Eligible geothermal energy property includes geothermal heat pumps and equipment used to produce, distribute, or use energy derived from a geothermal deposit. For electricity produced by geothermal power, equipment qualifies only up to, but not including, the electric transmission stage. For geothermal heat pumps, this credit applies to eligible property placed in service after October 3, 2008. Note that the credit for geothermal property, with the exception of geothermal heat pumps, has no stated expiration date.

Microturbines: The credit is equal to 10 percent of expenditures, with no maximum credit limit stated (explicitly). The credit for microturbines is capped at $200 per kW of capacity. Eligible property includes microturbines up to 2 megawatts (MW) in capacity that have an electricity-only generation efficiency of 26 percent or higher.

Combined Heat and Power (CHP) Systems: The credit is equal to 10 percent of expenditures, with no maximum limit stated. Eligible CHP property generally includes systems up to 50 MW in capacity that exceed 60 percent energy efficiency, subject to certain limitations and reductions for large systems. The efficiency requirement does not apply to CHP systems that use biomass for at least 90 percent of the system’s energy source, but the credit may be reduced for less-efficient systems. This credit applies to eligible property placed in service after October 3, 2008.

MACRS – Modified Accelerated Cost Recovery System

Under the federal Modified Accelerated Cost-Recovery System (MACRS), businesses may recover green building investments in certain property through depreciation deductions.

MACRS is a favorite tool of many solar photovoltaic array buyers because it accelerates the rate of return on solar energy investments.

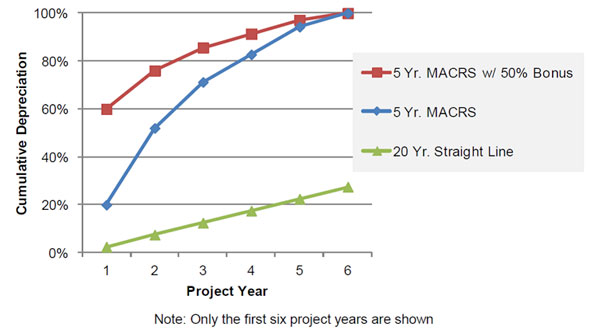

The following chart, from The Butler Firm, shows the benefits of MACRS for solar investments, compared to other assets which may have a depreciation period of over 20 years.

The MACRS establishes a set of “class lives” for various types of property, such as solar and wind, ranging from three to 50 years, over which the property may be depreciated. However, many renewable energy technologies are classified as five-year property.

Under MACRS, eligible green building property investments include:

- Solar Water Heat

- Solar Space Heat

- Solar Thermal Electric

- Solar Thermal Process Heat

- Photovoltaics

- Landfill Gas

- Wind/Small Wind

- Biomass

- Geothermal Electric

- Fuel Cells

- Geothermal Heat Pumps

- Municipal Solid Waste

- Combined Heat and Power (CHP/Cogeneration)

- Solar Hybrid Lighting

- Hydrokinetic Power (i.e., Flowing Water)

- Anaerobic Digestion

- Tidal Energy and/or Wave Energy

- Ocean Thermal

- Fuel Cells using Renewable Fuels

- Microturbines

- Geothermal Direct-Use

Qualifying solar energy equipment is eligible (described above in the ITC section) for a cost recovery period of five years. For equipment on which an Investment Tax Credit (ITC) or a 1603 Treasury Program grant is claimed, the owner must reduce the project’s depreciable basis by one-half the value of the ITC. This means the owner is able to deduct 85 percent of his or her tax basis.

Building owners may take advantage of both the MACRS system and the ITC and receive both a depreciation deduction of 85 percent of their tax basis and a credit of 30 percent (not an apples-to-apples comparison).

Residential Energy Efficiency Tax Credits

Two tax credits are available for residential homes (second homes qualify as well, but rentals do not) in which homeowners may receive a tax credit of 10 percent of cost, up to $500, or 30percent of cost with no upper limit.

10 Percent of Cost, Up to $500: This applies to energy efficiency improvements in the building envelope of existing homes and for the purchase of high-efficiency heating, cooling, and water-heating equipment. It includes insulation, energy-efficient exterior windows, doors, and certain roofs. Note that the cost of labor associated with the install does not qualify, with the exception of HVAC, water heaters, and biomass fuel systems.

Efficiency improvements or equipment must serve a U.S. dwelling that is owned and used by the taxpayer as a primary residence. The maximum tax credit for all improvements made in 2011 – 2014 is $500. The cap includes tax credits for any improvements made in any previous year. If a taxpayer claimed $500 or more of these tax credits in any previous year, any purchases made in 2011 – 2014 will be ineligible for a tax credit. It expires December 31, 2016.

30 Percent of Cost, with No Upper Limit: Applies to geothermal heat pumps, small wind turbines, and solar energy systems for both existing homes and new construction. Principle residences and second homes qualify, but rentals do not. The cost of labor to install the systems does qualify. This credit is almost analogous to the Business ITC described above, except it’s for residential property owners. The credit is set to expire on December 31, 2016.

PACE Financing

PACE stands for Property Assessed Clean Energy. The term “property assessed” refers to the fact that up to 100 percent financing for clean energy-related investments is available in the form of a property tax lien that is paid off through an assessment on the building’s property taxes, similar to a sewer assessment.

PACE programs are public-private partnerships that provide the stability and low risk of government financing with the flexibility of private investment programs.

In this article we’re focused primarily on commercial buildings, but there are both residential and commercial PACE programs available in many states throughout the U.S.

While not a common strategy, PACE offers incredible incentives for owner-occupied buildings and for creative investors, regardless of their investment time horizon.

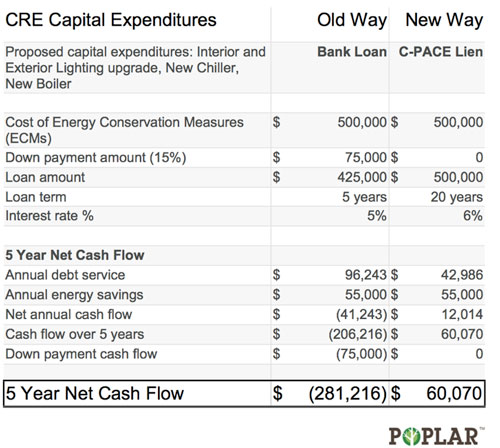

Before PACE, the “old” way of making capital improvements to a property often required enduring negative cash flow. Building owners either committed to investing their own cash out of pocket or took on incremental debt in the form of short-term bank financing. In either case, the return on investment associated with the capital improvements was forecasted to occur well into the future, if ever.

With PACE financing, the economic benefits of energy conservation often outweigh the costs of the conservation measures over their expected useful life.

With PACE financing, the economic benefits of energy conservation often outweigh the costs of the conservation measures over their expected useful life.

Instead of coming out of pocket to fund necessary capital improvements to experience negative cash flow, owners see positive cash flow and no out of pocket costs. In some states with PACE programs, such as Connecticut PACE (CPACE), as shown in the table below, the capital expenditures must generate positive cash flow in year one to be approved.

PACE financing can be used in combination with the aforementioned MACRS depreciation, 179D tax credit, and the Business ITC. How awesome is that?!?

PACE financing varies from state to state; however below is an illustration of “old” vs. “new” approaches in terms of cash flow, with CPACE as an example.

Many PACE proponents across the U. S. believe Connecticut’s CPACE program leads the market with the thoroughness and thoughtfulness of its commercial financing program.

—

This article is for informational purposes only and is not to be construed as legal or tax advice. Consult a certified public accountant (CPA) and/or licensed attorney for such advice.

For more information about green buildings, LEED certification, and sustainable facilities, visit http://www.poplarnetwork.com.

Side by side, we move metal fabrication forward.

FMA unites thousands of metal fabrication and manufacturing professionals around a common purpose: to shape the future of our industry, and in turn shape the world.

Learn More About FMA

.jpg)