How You Can Finance Solar Roof Painlessly with PACE

By Troy Libbra | December 15, 2015

Category:

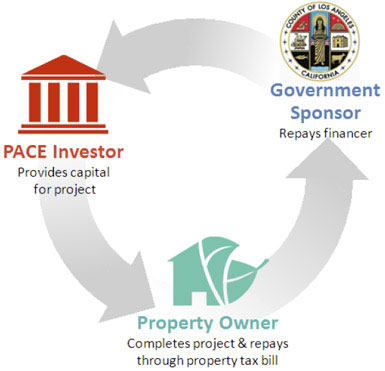

Through property assessed clean energy (PACE) programs, investors fund plant owners’ energy or water projects. Those owners who repay the expenditure over a long period based on their property value increases.

You’re a manufacturer interested in installing a solar array to help power your plant. However, you’re concerned about tying up your cash flow or jeopardizing your ability to finance other manufacturing capital expenditures.

Fear not! There is an innovative way to fund your building improvements and instantly enhance your property value, called property assessed clean energy (PACE).

PACE Explained

According to PACENation, PACE is a simple and effective way to finance energy efficiency, renewable energy, and water conservation upgrades to buildings. PACE can pay for new heating and cooling systems, lighting improvements, solar panels, water pumps, and insulation.

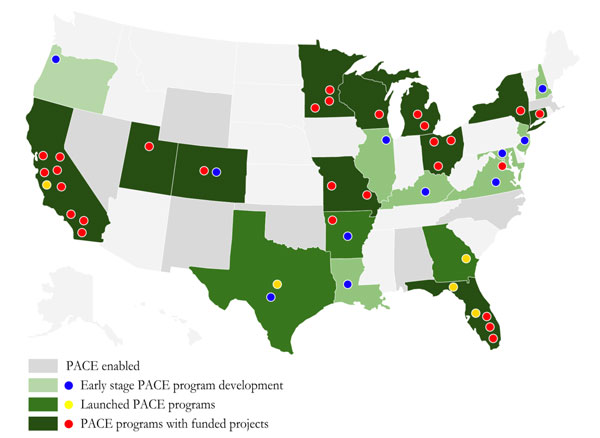

is growing across the country as an innovative financing mechanism.

PACE is growing across the country as an innovative financing mechanism. Torn from the playbook of governing bodies, it is an adaptation of a common financing technique used for decades throughout the U.S. by municipalities and counties to make energy efficiency upgrades and install on-site renewable energy projects. Borrowers repay the debt through a special property assessment. It is much like a special assessment district bond, but one applicable only to a specific property.

Just as PACE statutes authorize municipalities and counties to work with private sector lenders to provide upfront financing to property owners for qualified projects, they do the same for industrial building owners. Repayment is collected through annual assessments on the property’s real estate tax bill.

The PACE assessment obligation stays with the building upon sale and allows the owners to pass payments through to tenants or successive owners who benefit from improved free or reduced energy and lower utility costs. PACE also can be combined with local, state, and federal incentives, utility rebates, and tax deductions to achieve even greater cash flow impact.

Long-term, Whole Project Lending

While the commercial lenders generally provide only five- to seven-year financing for similar improvements, PACE offers secured capital for as many as 25 years. PACE can be used to finance 100 percent of a project’s costs with a repayment term matching the useful life of the implemented measures. Most solar PV arrays are guaranteed to operate at least 80 percent of their capacity for at least 25 years, so PACE capital likely would be for a 25-year term, for example.

While the commercial lenders generally provide only five- to seven-year financing for similar improvements, PACE offers secured capital for as many as 25 years. PACE can be used to finance 100 percent of a project’s costs with a repayment term matching the useful life of the implemented measures. Most solar PV arrays are guaranteed to operate at least 80 percent of their capacity for at least 25 years, so PACE capital likely would be for a 25-year term, for example.

The long-term nature of PACE financing allows plant owners to pursue capital-intensive, major building improvements by combining multiple technologies with long and short payback periods.

Factories Good Prospects for PACE

PACE funds can be used to retrofit any type of industrial building, but existing manufacturing plants have characteristics that make them strong candidates for using PACE. Buildings with high energy use because of inefficient equipment, long hours of operation, and multiple tenants are good examples. Owners who are concerned about making buildings more sustainable, interested in incorporating new technologies, and improving occupant comfort can achieve their goals using PACE.

In the U.S., most of the energy and electricity Americans consume is in buildings, and the industrial segment consumes more energy in its buildings and operations than any other segment, according to the U.S. Department of Energy. In energy-inefficient buildings, every day that passes is another day of missed opportunity to save money and increase building property values.

The innovative aspects of PACE—especially its long-term payback period that allows for cash-flow-positive projects—mean that PACE meets the needs of many plant owners who don’t find other financing options feasible. Older plants often desperately need upgrades, but old forms of financing aren’t always feasible or affordable. Today’s industrial building owners, plant managers, and operations managers are sorely in need of this new approach.

Best of all, PACE leverages an opportunity that’s already ripe for the taking. Most buildings are already losing energy dollars that can be reclaimed by improving the efficiency of building systems. Solar energy and other renewable energy resources that are now going unclaimed can be tapped. PACE is a simple way to reclaim money currently going to waste/

PACE is set to become a major force in the U.S. energy landscape as well as a driver of local economic development. Since 2009, PACE has scaled up with an average year-over-year growth rate in total financing of over 75 percent. States and municipalities have increasingly enabled PACE, with active programs in operation in many major population centers. Unlocking the efficiency improvement opportunity in buildings could translate to more than $1 trillion in energy savings, millions of jobs, and a reduction of some 600 million metric tons of carbon emissions per year.

Troy Libbra, Azimuth Energy, St. Louis, can be reached at troy@azimuthenergy.net>

Side by side, we move metal fabrication forward.

FMA unites thousands of metal fabrication and manufacturing professionals around a common purpose: to shape the future of our industry, and in turn shape the world.

Learn More About FMA